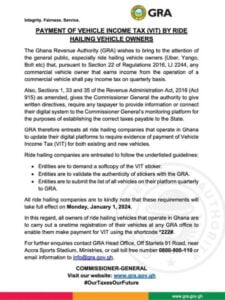

Starting January 1, 2024, ride-hailing vehicle owners, including those associated with platforms such as Uber, Yango, and Bolt, are mandated to comply with the newly introduced tax policy known as the Value Income Tax (VIT)

The Ghana Revenue Authority (GRA) has officially communicated this directive to ensure that commercial vehicle owners earning income from their operations adhere to Section 22 of Regulations 2016, LI 2244.

According to the GRA, any commercial vehicle owner generating income through their vehicles must now pay income tax on a quarterly basis. To facilitate this process, the Authority has instructed ride-hailing companies to promptly update their digital platforms, integrating the necessary adjustments to accommodate the new tax requirements.

For seamless compliance, ride-hailing firms are required to acquire a softcopy of the VIT sticker, verify its authenticity through the GRA, and furnish the GRA with a quarterly compilation of all vehicles operating under their platforms. These guidelines are crucial for ensuring that ride-hailing companies operate in accordance with the taxation laws outlined by the GRA.

Press Release: GRA Introduces Value Income Tax (Bolt, Uber etc.)

Press Release GRA

It is imperative to note that the GRA has underscored the strict enforcement of these tax requirements, commencing on January 1, 2024. Vehicle owners associated with ride-hailing services in Ghana are urged to familiarize themselves with these guidelines and initiate the necessary steps to align with the upcoming tax obligations. This move by the GRA is aimed at ensuring a fair and transparent taxation system within the ride-hailing industry.